Groupe Ariel Sa Case Analysis

Our Homework Writing Disciplines

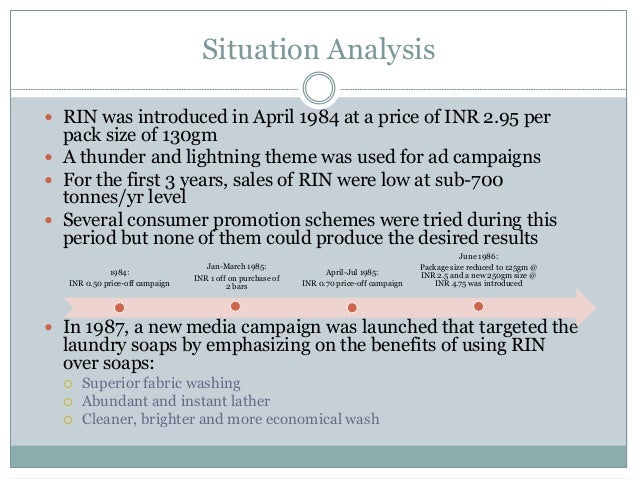

This kind of analysis is common for companies that are operating in many countries. Groupe Ariel is one such company that is considering investing in a project in its own subsidiary in Mexico. The company manufactures and sells printers, copiers and other document production equipment in many countries. As far as, expansion into new markets is concerned, company is very slow in taking initiatives as compared to its competitors owing to the recent recession. But the management of Groupe Ariel Sa Case Analysis company believes that better durability and lower source service costs of their products enable the company to build customer loyalty.

The company is now considering replacing the manual equipment used for recycling in Mexico by new equipment that requires less material and labour costs. But, the uncertainty linked with certain macroeconomic factors Groupe Ariel Sa Case Analysis exchange rate, inflation and interest rate has made the valuation of the project very complex. How should this NPV be translated into Euros? For the purpose of calculating NPV in Pesos, incremental cash flows of the project for the next 10 years should be calculated first. This cost isPesos. The cash value ofPesos obtained by selling the manual equipment should be subtracted from this amount to come up with the net out flow. As far as, the inflows of cash for next 10 years are concerned, they can be calculated by taking the difference of more info cost of operating both manual and new equipments.

Essay Writing Service

These amounts of tax savings should be added to the incremental cost savings for each year to come up with the total cash inflows. The present value of all these cash inflows and outflows can be calculated by discounting https://modernalternativemama.com/wp-content/custom/essay-service/english-editing-service.php at This rate is calculated by assuming that the purchasing power parity holds in this scenario.

Hence, this rate can be regarded as opportunity cost of investment because it is the second best alternative for the company for investment purposes. So, the NPV can be calculated by taking the sum of present values of all the cash flows. This NPV comes out to be 3, Pesos.

The spot exchange rate is Hence, by dividing 3, by NPV calculated for this scenario comes out to beEuros. The first thing required for calculating NPV in Euro is the forward premium. It is calculated by adding 1 to the inflation rates of France and Mexico respectively, and then by taking their ratio.]

![[BKEYWORD-0-3] Groupe Ariel Sa Case Analysis](https://www.coursehero.com/thumb/1a/ae/1aae32df30126d64e26e08a178c95f3065ed77a1_180.jpg)

Magnificent phrase: Groupe Ariel Sa Case Analysis

| Groupe Ariel Sa Case Analysis | 991 |

| Groupe Ariel Sa Case Analysis | For this case, it was necessary to analyze the net present value of the project. Groupe Ariel S.A. would only go forward with the project if the NPV is positive. A distinction was also made between the Euro and Mexican peso in order to determine which currency Groupe Ariele should choose to go with in order to maximize their return. Feb 22, · This case discusses Cross-Border valuation of projects. This kind of analysis is common for companies that are operating in many countries. Groupe Ariel is one such company that is considering investing in a project in its own subsidiary in Mexico. The company manufactures and sells printers, copiers and other document production equipment in many countries. [ ]. This case discusses Cross-Border valuation of projects. This kind of analysis is common for companies that are operating in many countries. Groupe Ariel is one such company that is considering investing in a project in its own subsidiary in Mexico. The company manufactures and sells printers, copiers and other document production equipment in many countries. |

| SIERRA LEONE REBELS | Cultural Diversity Multiculturalism and Inclusion In writing |

Groupe Ariel Sa Case Analysis - happens

This kind of analysis is common for companies that are operating in many countries. Groupe Ariel is one such company that is considering investing in a project in its own subsidiary in Mexico. The company manufactures and sells printers, copiers and other document production equipment in many countries. As far as, expansion into new markets is concerned, company is very slow in taking initiatives as compared to its competitors owing to the recent recession. But the management of the company believes that better durability and lower after-sales service costs of their products enable the company to build customer loyalty.

buy a research paper for college

2022-06-30

Zulkisho

I think, that you are not right. I can prove it. Write to me in PM, we will discuss.

Baseball and Its History

2022-06-30

Branris

The absurd situation has turned out

Self-Mediation-Based Intervention Paper

2022-07-01

Kajijora

I congratulate, this rather good idea is necessary just by the way

Category

Best Posts

- all the kings men 2

- Obscenity And Sexuality In Millers Tropic Of Cancer

- The Differences Between Ancient And Ancient Civilizations

- write my research paper

- Social Work In Pakistan Case Study

- professional thesis editing

- Personal Narrative: The Lady Of Guadalupe

- Charlemagne The King Of The Ages

- quote prejudice

- Bangladesh Essays

- Otis D. Ritch on Native American Authors

- multiple chioce quiz on transfer pricing

- The Importance Of Family Relationship Systems

- big five personality traits 182910

317

317