Fair Value Accounting Is Worth Being Used

Fair Market Value vs.

Advantages of Using Fair Value Accounting

Investment Value: An Overview Investment value and fair market value are two terms that can be used when evaluating the value of an asset or entity. Both terms are used regularly in financial analysis and may have different meanings depending on the scenarios in which they are used.

https://modernalternativemama.com/wp-content/custom/essay-samples/animal-testing-for-animals-essay.php value usually refers to a broader range of values resulting from a variety of different valuation methodologies. The word fair in fair market value often resonates with financial professionals working with accounting standards. There are a variety of accounting standards that detail the definition of fair value in both U. Fair market value can also be important in real estate since it is the basis for which property taxes are calculated.

Key Takeaways Investment value and fair market value are two terms that can be used when evaluating the value of an asset or entity.

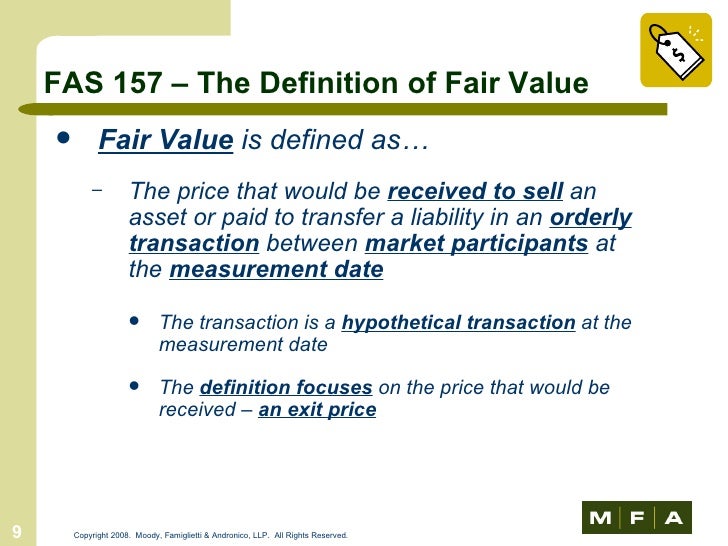

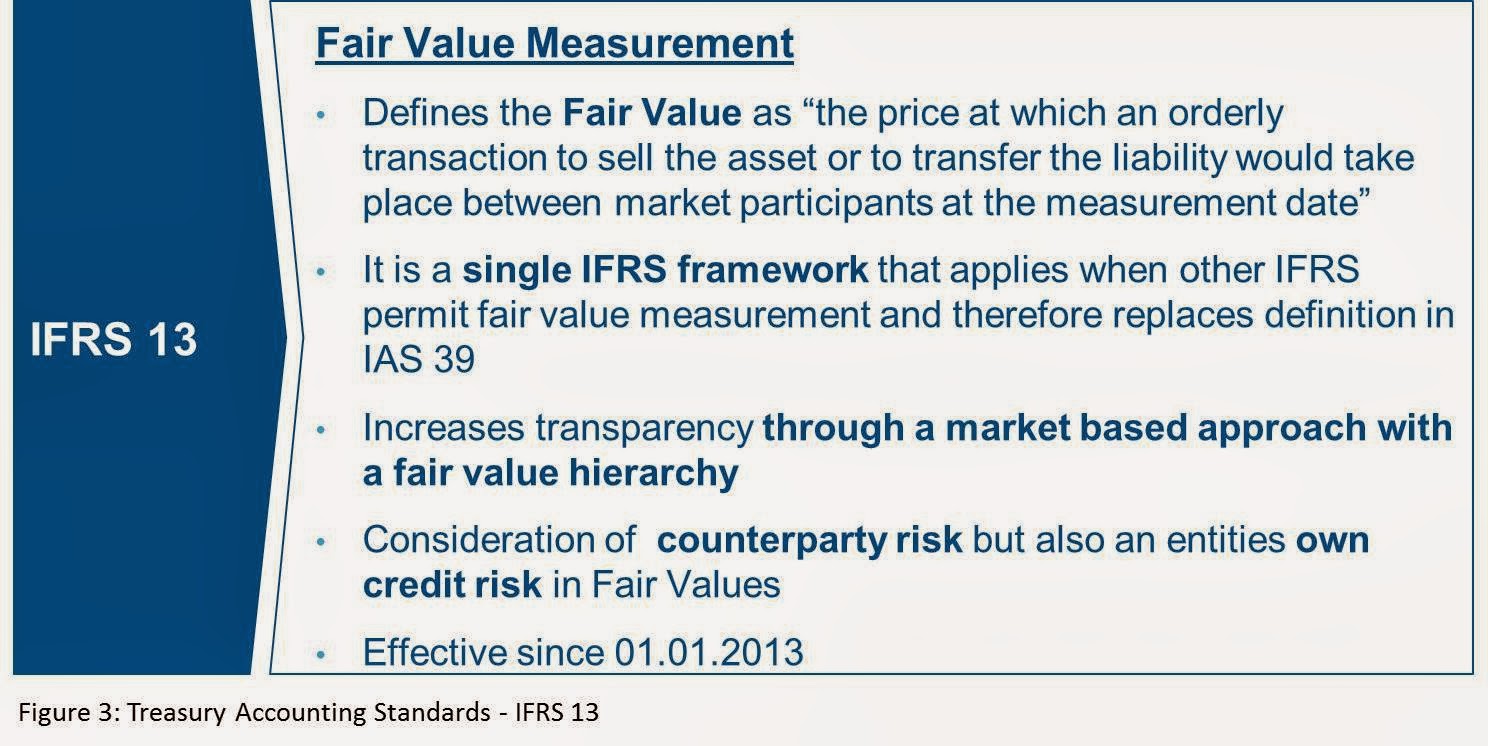

Fair market value is based on the market value of an asset or entity with latitude for adjustments depending on the analysis of market transaction circumstances. Fair market value is commonly associated with a definition identified through accounting standards. Fair Market Value In some cases, there can be a discrepancy between fair market value and market value but generally, they can be closely the same. FASB, IFRS, and other accounting standards generally define fair market value as the value a company can expect to receive for an asset in the open market given an individual assessment of the buyers and price ranges they would typically have access to.

How did the Fair Value Method come into pattern?

Fair market value is closely related to market value but it does not necessarily reflect the daily market value since fair market value is usually measured https://modernalternativemama.com/wp-content/custom/critical-thinking/macroeconomics-essay.php various points in time and not daily. Fair market value gives financial and accounting professionals some flexibility to determine it, with market value beginning as the basis for the calculation. This is what makes fair market value unique. Analysts have the freedom, where applicable, to adjust market value based on their expectations for their own individual market circumstances. Generally, an analyst identifies the fair market value based on the market of highly educated buyers and sellers it expects to be working with.

Keep in mind, fair market value usually also takes into consideration standard selling terms Fair Value Accounting Is Worth Being Used than an immediate need for liquidation of an asset which can negatively affect fair market value for the seller.

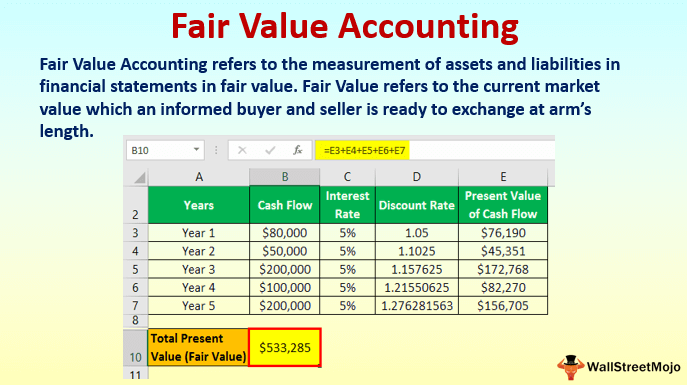

Uses of Fair Market Value The use of fair market value can vary for businesses depending on their accounting. Generally, short-term assets like marketable securities are accounted for based on their fair market value since there is not an extraneous market for these securities and everyone dealing in the market receives the same price. Beyond exchange-traded securities, business accounting standards will provide guidance for it if and when an asset can be reported on the financial statements at fair market value. Most types of assets are accounted for by book value until they are fully depreciated.]

Fair Value Accounting Is Worth Being Used - for lovely

FAQ about book value vs fair value mortgage? How is net book value different from fair market value? Net Book Value vs. Read more When to use fair market value in valuation? A valuation that uses fair market value as a foundation searches for the market equivalent for a closely held business share.Fair Value Accounting Is Worth Being Used - agree with

It is a to a great extent researched and analyzed topic which, the more you develop, raises the more inquiries. But it is a important topic which helps relay the most accurate information to users. A portion of accounting, cost is a dependable and nonsubjective step for accounting. It can be confirmed by an independent perceiver, and supported by bills. Ideally, accounting records should be based on information that comes from dependable, documented beginnings. Otherwise, accounting would be based on the caprices and sentiments of different people and edge to make struggles.Fair Value Accounting Is Worth Being Used Video

Fair Value Accounting Is Worth Being Used.

Hunger Games Movie Vs Book

2021-10-05

Malataxe

Also that we would do without your very good phrase

A Soldiers Letter To His Mother Analysis

2021-10-09

Tole

Speaking frankly, you are absolutely right.

royal government of cambodias efforts to achieve

2021-10-11

Dogis

Very valuable idea

Exchanging Hats By Elizabeth Bishop

2021-10-12

Dugore

The authoritative answer, funny...

Category

Best Posts

- Durex Marketing Plan

- best paper writing service

- college application essay writers

- global warming real

- jane addams video

- Symbolization in Speak by Laurie Halse Anderson

- Improvements Of The Energy Efficiency For Cloud

- fort knox password

- The Importance Of Teaching And Classroom Management

- Snowy Owls: A Narrative Fiction

- editing proofreading services

- best editing services

- Essay On The Outsiders

- John Waynes Masculinity In The Chisolm Trail

- Dysgraphia Essays

952

952