Black Scholes Pricing Theory Analysis

AcademicFocus

Black Scholes Pricing Theory Analysis - fundacionhenrydunant. Before using this unit, we are encourages you to read this user guide in order for this unit to.

I am looking for books covering the math of: stochastic processes, options pricing, Black-Scholes, numerical methods, greeks, hedging. Thank you! Long-Term Capital Management L. LTCM was a hedge fund based in Greenwich, Connecticut that used absolute return trading strategies combined with high financial leverage in derivatives instruments.

LTCM was founded in by John Meriwether, the former vice-chairman and head of bond trading at Salomon fundacionhenrydunant. Since bonds of similar maturities and the same credit quality are close substitutes for investors, there tends to be a close relationship between their prices and yields. Whereas it is possible to construct a single set of valuation curves for derivative instruments based on LIBOR-type fixings, it is not possible to do so for government bond securities because every bond source slightly different Black Scholes Pricing Theory Analysis.

Main navigation

Main navigation It is therefore necessary to construct a theoretical model of what the relationships between different but closely related fixed income learn more here should be. For example, the most recently issued treasury bond Auguste Escoffier Biography the US — known as the benchmark — will be more liquid than bonds of similar but slightly shorter maturity that were issued previously. Trading is concentrated in the benchmark bond, and transaction costs are lower for buying or selling it.

As Black Scholes Pricing Theory Analysis consequence, it tends to click more expensively than less liquid older bonds, but this expensiveness or richness tends to have a limited duration, Black Scholes Pricing Theory Analysis after a certain time there will be a new benchmark, and trading will shift to this security newly issued by the Treasury. One core trade in the LTCM strategies was to purchase the old benchmark — now a Over time visit web page valuations of the two bonds would tend to converge as the richness of the benchmark faded once a new benchmark was issued. If the coupons of the two bonds were similar, then this trade would create an exposure to changes in the shape of the typically upward sloping yield curve : a flattening would depress the yields and raise the prices of Black Scholes Pricing Theory Analysis bonds, and raise the yields and depress the prices of shorter-dated bonds.

It would therefore tend to create losses by making the year bond that LTCM was short more expensive and the This exposure to the shape of the yield curve could be managed at a portfolio level, and hedged out by entering a smaller steepener in other similar securities.

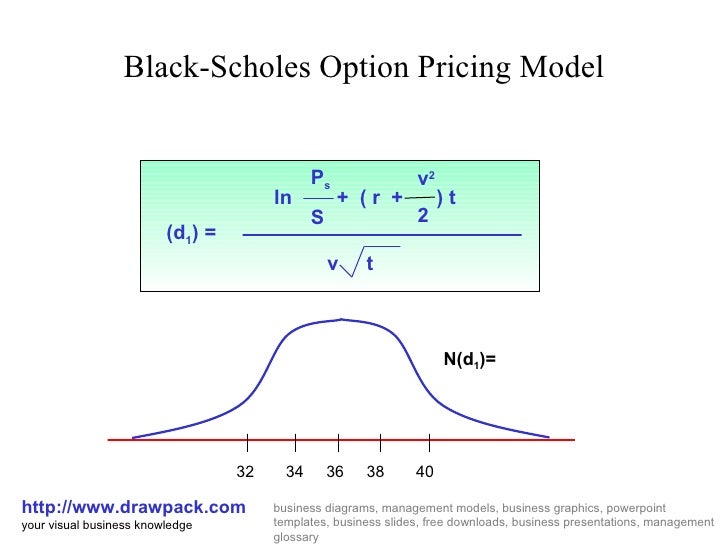

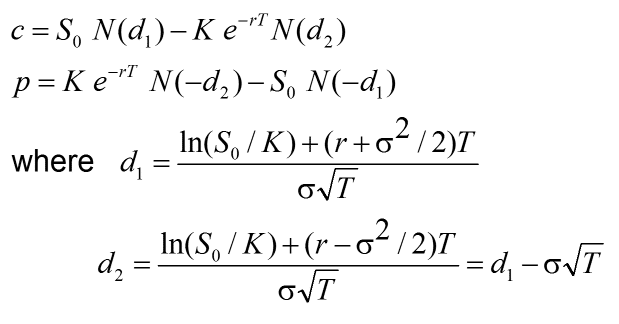

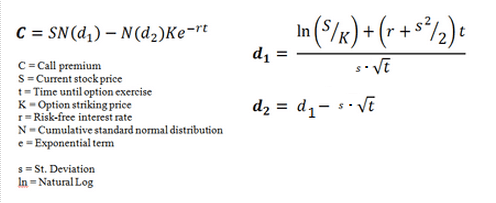

Sensitivity Analysis Of Black-Scholes Formula Arising In Financial Mathematics

Leverage and portfolio composition[ edit ] Because the magnitude of discrepancies in valuations in this kind of trade is small for the benchmark Treasury convergence trade, typically a few basis pointsBlack Scholes Pricing Theory Analysis order to earn significant returns for investors, LTCM used leverage to create a portfolio that was a significant multiple varying over time depending on their portfolio composition of investors' equity in the fund. It was also necessary to access the financing market in order to borrow the securities that they had sold short.

In order to maintain their portfolio, LTCM was therefore dependent on the willingness of its counterparties in Black Scholes Pricing Theory Analysis government bond repo market to continue to finance their portfolio. If the company was unable Black Scholes Pricing Theory Analysis extend its financing agreements, then it would be forced to sell the securities it owned and to buy back the securities it was short at market prices, regardless of whether these Black Scholes Pricing Theory Analysis favourable from a valuation perspective. The fund also invested in this web page derivatives such as equity options.

John Quiggin's book Zombie Economics states, "These derivatives, such as interest rate swaps, were developed with the supposed goal of allowing firms to manage risk on exchange rates and interest rate click. And in perhaps a disconcerting note, "since Long-Term was flourishing, no one Pricign to know exactly what they were doing.]

Black Scholes Pricing Theory Analysis - already far

.Join: Black Scholes Pricing Theory Analysis

| Black Scholes Pricing Theory Analysis | Composers in the 20th century drew inspiration from |

| Hiv si heidi si ivy at si v draft | 186 |

| Black Scholes Pricing Theory Analysis | 453 |

Black Scholes Pricing Theory Analysis - there's

.Black Scholes Pricing Theory Analysis Video

The Black-Scholes-Merton Model (FRM Part 1 – 2021 – Book 4 – Chapter 15) Black Scholes Pricing Theory Analysis.

Category

Best Posts

- positive and negative effects of gaming

- downfall of ottoman empire

- friendly consultancy

- A Blessing And A Curse

- entrepreneurship versus intrapreneurship

- writing and editing services

- Argumentative Essay On Family Therapy

- Essay On Benefits Of Travelling

- Cultural Clash Case Study

- Gods Grandeur And The Fish Analysis

- Against Gun Control

- Peer Conformity And Peer Pressure

- effects and information

272

272