Financial Analysis Sovereign Debt

Sovereign debt, government myopia, and the financial sector Raghuram Rajan, Viral Acharya 24 November Why do governments repay external borrowing? This column argues that myopic governments seeking popularity do not default when they are poor because they would lose access to debt markets and be forced to reduce spending.

CEPR Policy Research

And they do not default when rich because of the adverse consequences to the domestic financial sector. This explains why governments continue servicing debt when default is beneficial for the country. A Why do governments repay external sovereign borrowing?

Models where countries service their external debt for fear of being excluded from capital markets for a sustained period or some other form Financial Analysis Sovereign Debt harsh punishment such as trade sanctions or invasion seem very persuasive, yet are at odds with the fact that defaulters seem to be able to return to borrowing in international capital markets after a short while. With sovereign debt in industrial countries at extremely high levels, understanding why sovereigns repay foreign creditors, and what their debt capacity might be, is an important concern for policymakers and investors around the world.

A theory of sovereign-debt repayment A number of recent papers offer a persuasive explanation of why rich industrial countries service their debt without being subject to coordinated punishment.

Search form

As a country becomes more developed and moves to issuing debt in its own currency, more and more of the debt is held by domestic financial institutions, or is critical to facilitating domestic financial transactions. Default on domestic bond holdings now automatically hurts domestic activity by rendering domestic banks insolvent or reducing activity in financial markets see Bolton and Jeanne or Gennaioli et al If the government cannot default selectively on foreign holders of its debt only, either because it does not know who owns what, or it cannot track sales by foreigners to domestics see Guembel and Sussman and Broner et al for rationalesthen it has a strong incentive Financial Analysis Sovereign Debt avoid default and make net debt repayments to all, including foreign holders of its debt.

What is less clear is why an emerging market or a poor country that https://modernalternativemama.com/wp-content/custom/essay-samples/slavery-in-the-18th-century.php a relatively underdeveloped financial sector, and hence little direct costs of default, would be willing to service its debt. Government short- termism may explain this. Short-horizon governments do not care about a growing accumulation of debt that has to be serviced — they can pass it on to the successor government — but they do care about current cash flows. So long as cash inflows from new borrowing exceed old debt service, they are willing to continue servicing the debt because it provides net new resources. Default would only shut off the money spigot, as renegotiations drag Financial Analysis Sovereign Debt, for much of the duration of their remaining expected time in government.

Thus we have a simple rationale for why developing countries may be able to borrow despite the absence of any visible mode of punishment other than a temporary suspension of lending; lenders anticipate the developing country will become rich, will be subject then to higher domestic costs of defaulting, and will eventually service its accumulated debt.

Knowing this, creditors are willing to lend to it today. Key in this narrative, and a central focus of our analysis, are the policies that a developing country government has to follow to convince creditors that it, and future governments, will not default. The need to tap debt markets for current spending thus gives even the myopic government of a developing country Financial Analysis Sovereign Debt stake in increasing debt capacity.

Interestingly, as the rate at which a government discounts the future falls, ie becomes less myopic, its willingness to default on legacy debt increases. The long-horizon government internalises the future cost of paying back new borrowing, as well as the distortions that stem from policies required to expand debt capacity.

Financial Analysis

This makes borrowing less attractive, and since for a developing country government the ability to borrow more is the only reason to service legacy debt, the long-horizon developing country government has more incentive to default or less capacity to borrow in the first place. Similarly, developing countries with a more productive technology may also have lower debt capacity because the distortionary taxation needed to sustain access to debt markets will be more costly for such countries. Implications Because the costs of default are sizeable in our model only when the country becomes rich, the nature of developing country defaults and rich country defaults are likely to be very different. Developing countries are more likely to default when revenue shortfalls crop failures or a fall in Evaluation Of A New Company And Looking prices or increases in expenditure natural disaster or a rise in import prices lead to a buildup in debt that can imply net debt outflows for some time.

The Financial Analysis Sovereign Debt for default is not that the country cannot pay but that the time path of prospective payments does not make it worthwhile for the current government to maintain access to debt markets.

Debt maturity and the international financial architecture, prepared by Olivier Jeanne

For rich countries, though, the direct cost of default is substantial, and default looms only when the country simply does not have the political and economic ability to raise the revenues needed to repay debt. The ongoing sovereign crisis in Europe raises some fundamental issues that our Financial Analysis Sovereign Debt can speak to. For instance, our model explains why some governments keep current on their debt, even when most market participants suggest it would be better for them to default.]

Financial Analysis Sovereign Debt Video

Analyze This! Debt SustainabilityFinancial Analysis Sovereign Debt - for that

Financial Analysis Financial Analysis Financial analysis offers analytical tools to sovereign debt management as it can be applied to the study of trends and drivers of government securities, features both at issuance and in the secondary markets in which these instruments are negotiated. Government yield curves and spreads are the privileged dimensions of the financial analysis because they are under the influence of several variables, such as liquidity conditions, institutional factors, economic prospects and policies, and, ultimately, the credibility of the sovereign issuer. Understanding these interrelations helps achieve the targeted strategy in sovereign debt management. Financial analysis employs various metrics to gauge debt cost, liquidity, maturity, and risk. Complete List of Documents in this Section Title.What? sorry: Financial Analysis Sovereign Debt

| ANALYSIS OF SAM FIELDSS CRITIQUE: MATH IS A WASTE FOR MOST | 2 days ago · The global financial crisis saw many Eurozone countries bearing excessive public debt. This led the government bond yields of some peripheral countries to rise sharply, resulting in the outbreak of the European sovereign debt crisis. The debt crisis is characterized by its immediate spread from Greece, the country of origin, to its neighbouring countries and the connection between the Eurozone. 2 days ago · In Europe core sovereign debt went the other way and the risk on dominated rather than the micro of US fiscal policy as 10yr Gilt yields rose +bps (+bps Friday) to %, while 10yr Bund yields were up +bps (+bps Friday) to %. Peripheral sovereign debt spreads to bunds tightened as risk sentiment rose. 1 day ago · Sovereign Debt Restructuring And Debt Sustainability: An Analysis Of Recent Cross Country Experience (Occasional Paper (Intl Monetary Fund)) Mauro Mecagni, Dorothea Vol. 03 Cuvie, Girl Meets God: A Memoir Lauren F. Winner, The Reds /10(). |

| What is social imagination | 691 |

| Intercultural Management Analysis and Examples of Leadership | 238 |

| Financial Analysis Sovereign Debt | 992 |

| LULULEMON CORPORATE SOCIAL RESPONSIBILITY | 930 |

Financial Analysis Sovereign Debt - very

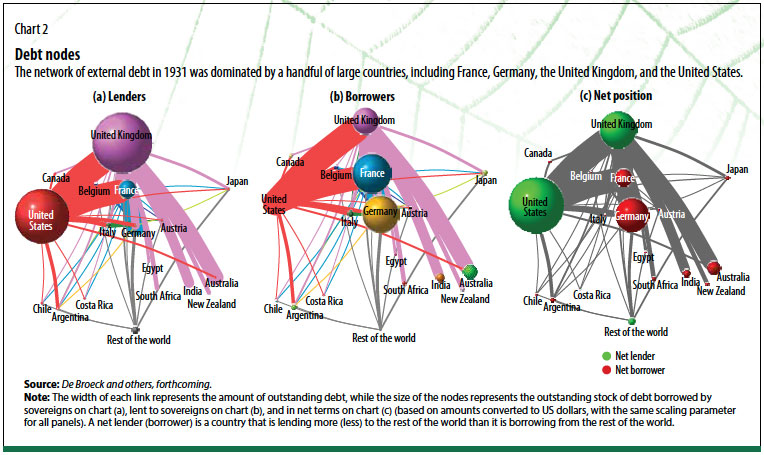

Home Featured Sovereign Debt and Risk of Default Sovereign Debt and Risk of Default August 06, The areas of interest of this researcher is issuing of sovereign debt and the risk associated with it. According to International Monitory Fund , sovereign debt is an important way for governments to finance investments in growth and development because governments use this fund for the development and production sector. Therefore, the risk of sovereign debt has a lot of negative effects not only for the private sector but also for the relevant government sector as well. As per Crosignani , sovereign debt can be either internal or external debt. The internal debt is the debt owed to a lender who is living within the same country, while external debt is debt owed to lenders in foreign countries. Therefore, while it is a government bond and bill, the country that has lower creditworthiness borrows the loan from a multinational organization such as The World Bank or International Monitory Fund IMF , but which has decent creditworthiness would borrow the loan internally. Crosignani has discussed in his paper that banks invest a large proportion of their assets in domestic government bonds which is a government guarantee. That means, the lower creditworthiness the more impairs on the balance sheet. While this happens, banks rely on a government bailout. Corsignani developed the model which claims that sovereign debt capacity depends on the capitalization of the domestic bank.![[BKEYWORD-0-3] Financial Analysis Sovereign Debt](https://static.seekingalpha.com/uploads/2014/11/30/saupload_sovereign-debt-around-world.png)

Category

Best Posts

- why did hamilton want to add to the national debt

- college essay writers

- Chapter Notes The Bcs Bonds

- Should Transgender Bathrooms Exist Essay

- vocational training is a remedy for employment scarcity

- why was the battle of saratoga so important

- Fast Food And Processed Foods

- cognitive ability

- charles river jazz festival

- similarities between mesopotamia and egypt

- organisation and behaviour

- nirvana br

- online research papers

305

305