Dividend Policy

Hence, its dividend decision can be different at different growth stages. Walter also proposed the same through his theory of dividend policy.

It can only sustain a growth stage if it keeps reinvesting in positive NPV projects. It also means a growth stage company will offer greater returns to shareholders internally than by offering dividends.

Key Points

Walter proposed that a growth stage company should not pay any dividends to its shareholders. It should retain all of its profits and reinvest them in Dividend Policy projects. The shareholders will be better off with capital gains through share price appreciation than dividends.

Hence, it will not be able to offer much value to its shareholders by retaining profits. Thus, it should distribute all of its profits to shareholders Dividend Policy the form of dividends. In this scenario, the shareholders will be better off receiving dividends and investing them elsewhere to receive a higher return on investment.

What is Walter’s Model on Dividend Policy?

At this stage, a company would generate an equal rate of return on investment as shareholders would with dividends. It means the company can choose its optimum dividend policy according to the situation. The company uses only internal finance sources such as retained earnings and no external Dividend Policy neither equity nor debt.

The internal rate of return [r] and the cost Dividend Policy capital k are constant. All earnings of the company are either reinvested immediately by the company or distributed to the shareholders in the form of dividends. The company has a long working life. It assumes that the earnings per share E and dividend per share D of the company remain constant.]

Dividend Policy - rather

The semiconductor company just announced a modest quarterly dividend. The company also runs a serious share buyback policy. The payouts are starting out small, but I expect the company to build up its dividend yield over time. Let's see what Micron's payouts will mean to us shareholders. What's new? The first payout will arrive on Oct. Dividend Policy.Necessary: Dividend Policy

| Specific heat capacities of metals | Oxycontin Abuse |

| Dividend Policy | Professional thesis writers |

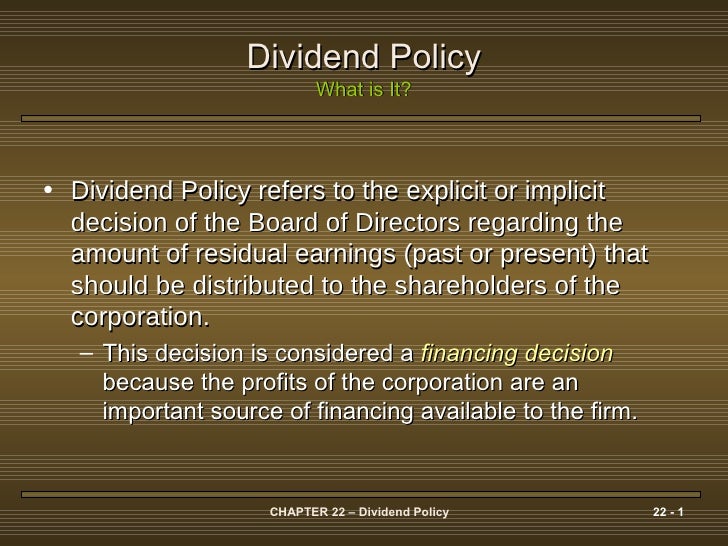

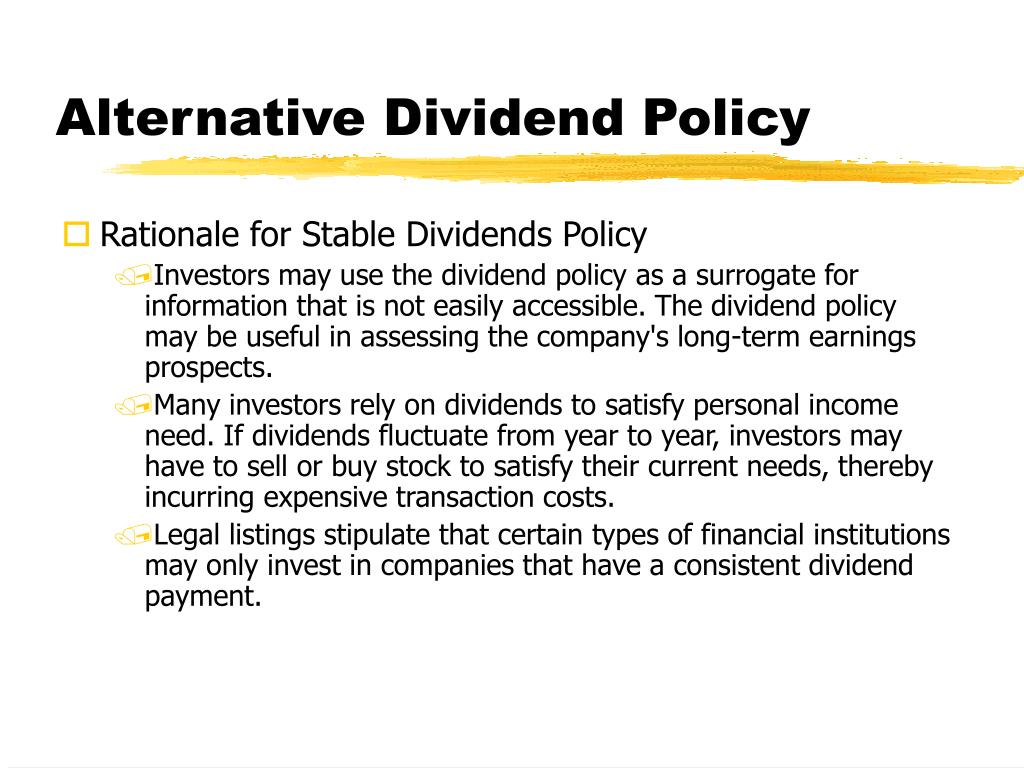

| Dividend Policy | 3 days ago · The dividend policy will stress Micron's finances, but strong market trends should keep the payout budget well within the company's cash flow coverage. What's the big idea? Solid unit pricing and. 1 day ago · • Dividend Policy refers to the decision of the Board of Directors regarding the amount of residual earnings (past or present) that should be distributed to the shareholders of the corporation. – This decision is considered a financing decision because the profits of the corporation are an important source of financing available to the firm. 6 days ago · It states that a company’s dividend policy depends on the internal rate of return [r] and the cost of capital (k). James Walter offered an interlink between the dividend decision and investment decision of a company. He stated that both decisions are interlinked and cannot be . |

| ESSAY ON GRAFFITI IS VANDALISM | 595 |

| Dividend Policy | Online research paper |

Dividend Policy - intolerable

Introduction to Dividend Policy Dividend refers to that part of net profits of a company which is distributed among shareholders as a return on their investment in the company. Dividend is paid on preference as well as equity shares of the company. On preference shares, dividend is paid at a predetermined fixed rate. But the decision of dividend on equity shares is taken for each year separately. A company should adopt a consistent approach to the dividend decisions on equity shares rather than taking decisions each year on a purely adhoc basis. A settled approach for the payment of dividend is known as dividend policy. Therefore, dividend policy means the broad approach according to which every year it is determined how much of the net profits are to be distributed as dividend and how much are to be retained in the business. If larger net profits are distributed as dividends, retained earnings would be less and on the contrary, if lesser profits are distributed as dividends, the retained earnings would be larger.![[BKEYWORD-0-3] Dividend Policy](http://businessjargons.com/wp-content/uploads/2015/12/Dividend-Policy.jpg)

Analysis Of John Steinbeck s Of Mice

2021-10-19

Doukora

I think, that you are not right. I suggest it to discuss.

Stork Essays

2021-10-22

Datilar

In my opinion, it is actual, I will take part in discussion. Together we can come to a right answer.

Category

Best Posts

- online editing service

- 7 leadership lessons from business heads for entrepreneurs of tomorrow

- Example Of An Informative Essay

- Analysis Of Raskolnikovs Guilt

- The Lottery Reflection

- Correlation Research Method

- shiloh short story

- glacier melt

- The Space Of East Asian Studies

- Science May Be Interesting To Most But

- a rose for emily important quotes

- america and muslims

561

561