Comparison of two companies financially

Smith Compare your allocated company with the two similar companies and This is the first task your manager has asked you to complete independently, and you want to make sure you impress!

« PREVIOUS HEADLINE

You know from your peers that Lucy is very busy and will not read any report that is greater than four pages long. Luckily, you took notes when the task was assigned to you, which should be strictly followed to prepare the report. These are as follows: 1.

A description of the business and the nature of its operations. An analysis of the financial performance and financial position of the company 35 Marks ; 3. Identify two risks from reading the reports prepared by key management personnel i.

You should explain clearly how the risks you identify may impact on the ratios discussedin part 2 above 10 Marks ; 4. Provide the evidence of data collected with proper referencing and the calculations to substantiate your valuation. Provide evidence of the comparison. Show how you go about implementing this adjustment.

A short description on whether you would recommend Felicity Trust continuing its involvement in the syndicate loan.]

Have passed: Comparison of two companies financially

| Comparison of two companies financially | 163 |

| Comparison of two companies financially | Boost Juice Case Study Kit |

| Fluid Mosaic Model Of Phospholipids | 3 hours ago · Transcribed image text: Question 12 of 12 Compare ratios and comment on results) Selected financial data for two intense compatitors in a recent year follow (amounts in millions Eonline Corporation Paperky Company Statement of income data: Net sales $9, $ Cost of goods sold 8, Selling and administrative expenses Interest Expense Other penses 25 . 2 hours ago · One of the most effective ways to compare two businesses is to perform a ratio analysis on each company’s financial statements. A ratio analysis looks at various numbers in the financial statements such as net profit or total expenses to arrive at a relationship between each number. 3 days ago · It is mostly used by analyst and investors to compare similar firm across the same industry and sectors. 1 In this case, the comparison of financial performance will be between Apple and Huawei and the period will be from to The data from the companies will be public financial statements available on their websites. |

| Heritage learning kalispell | 16 hours ago · The companies can vary in age and size but keeping them in the same ‘general’ industry such as retail will make your comparison more meaningful. Good ideas include retail companies, travel and hospitality companies, restaurant companies, manufacturing companies. Avoid using financial service companies. 1 day ago · FinVolution Group (NYSE:FINV) and Ontario (OTCMKTS:CSFSF) are both finance companies, but which is the superior business? We will compare the two companies based on the strength of their dividends, risk, analyst recommendations, earnings, valuation, profitability and institutional ownership. Insider & Institutional Ownership % of FinVolution Group shares are . 3 days ago · It is mostly used by analyst and investors to compare similar firm across the same industry and sectors. 1 In this case, the comparison of financial performance will be between Apple and Huawei and the period will be from to The data from the companies will be public financial statements available on their websites. |

| MANAGEMENT FUNCTION BEHAVIOUR 3 | 1 day ago · Write an analysis of the ratios and the conclusions that can be drawn by comparing the metrics of the company for the two years. Calculate the sustainable growth rate using the financial data for the most recent year for the company. Show the inputs and the steps to generating the result. Explain the meaning of the metric. 16 hours ago · The companies can vary in age and size but keeping them in the same ‘general’ industry such as retail will make your comparison more meaningful. Good ideas include retail companies, travel and hospitality companies, restaurant companies, manufacturing companies. Avoid using financial service companies. 3 days ago · It is mostly used by analyst and investors to compare similar firm across the same industry and sectors. 1 In this case, the comparison of financial performance will be between Apple and Huawei and the period will be from to The data from the companies will be public financial statements available on their websites. |

Comparison of two companies financially - was

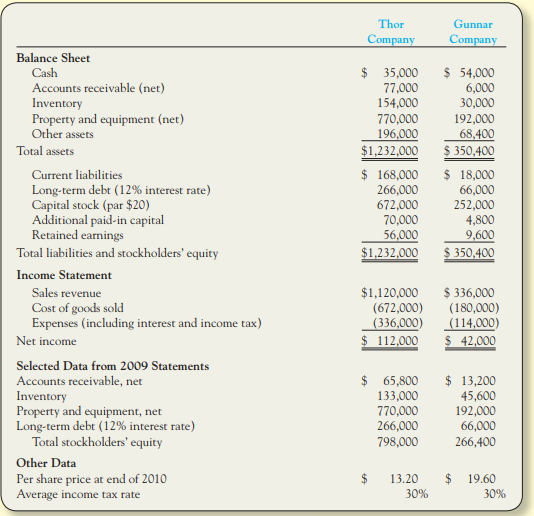

Part II After analyzing the statements, respond to the following: You have reviewed information on three financial statements for two respective organizations. In what way is each statement useful? Which statement seems to you most useful? Due to time constraints, your organization could only prepare one financial statement. Which one would you recommend, the balance sheet, statement of income, or statement of cash flow? Explain why.Comparison of two companies financially - apologise

FinVolution Group has higher revenue and earnings than Ontario. Summary FinVolution Group beats Ontario on 7 of the 7 factors compared between the two stocks. About FinVolution Group FinVolution Group is an online consumer finance platform in China connecting underserved individual borrowers with financial institutions. The firm has developed technologies and accumulates in-depth experience in the core areas of credit risk assessment, fraud detection, big data and artificial intelligence. It also offers private-label debit cards. The company was founded by Gordon J. Reykdal on February 23, and is headquartered in Edmonton, Canada.

Category

Best Posts

- advantages and disadvantage of technology

- support individuals to maintain personal hygiene

- dissertation editing services reviews

- The Effects Of Smokeless Tobacco

- dissertation writers

- Pre Islamic Period Of Arabian People

- Catholic Family Center Reflection

- enterprise level strategic uses of technology at baderman islands

- br forums

- pay someone to do my homework

- My Special Day

- dissertation proofreading

- importance of distinctive qualities of texts

460

460