The federal personal income tax is a progressive tax

Will the child tax credit be automatically deposited?

Post navigation

How is the federal income tax a progressive tax quizlet? Federal income taxes are progressive. Take a smaller share of income as the amount of income grows.

Sales taxes are regressive, because people with lower incomes pay a larger percentage of their income for sales taxes than people with higher incomes do. Reduces taxable income and thus your total tax. Is the federal individual income tax progressive or regressive? Overall, yes.

Effects of Alternative Trade Union Policy Submissions Essay

The overall federal tax system is progressive, with total federal tax burdens a larger percentage of income for higher-income households than for lower-income households. Not all taxes within the federal system are equally progressive.

How is the federal income tax a progressive tax Brainly? The federal income tax is a progressive tax because the tax amount is charged according to the income of the person.

The rich will pay the tax according to him or her, and the poor will pay the tax less according to their income. Further Explanation: People will pay the tax according to their income.

Recent Posts

READ: How is hospital care paid for when a patient is uninsured? Why was it difficult for the federal government to establish an income tax? A constitutional amendment was necessary because the Supreme Court had struck down the earlier income tax as unconstitutional.

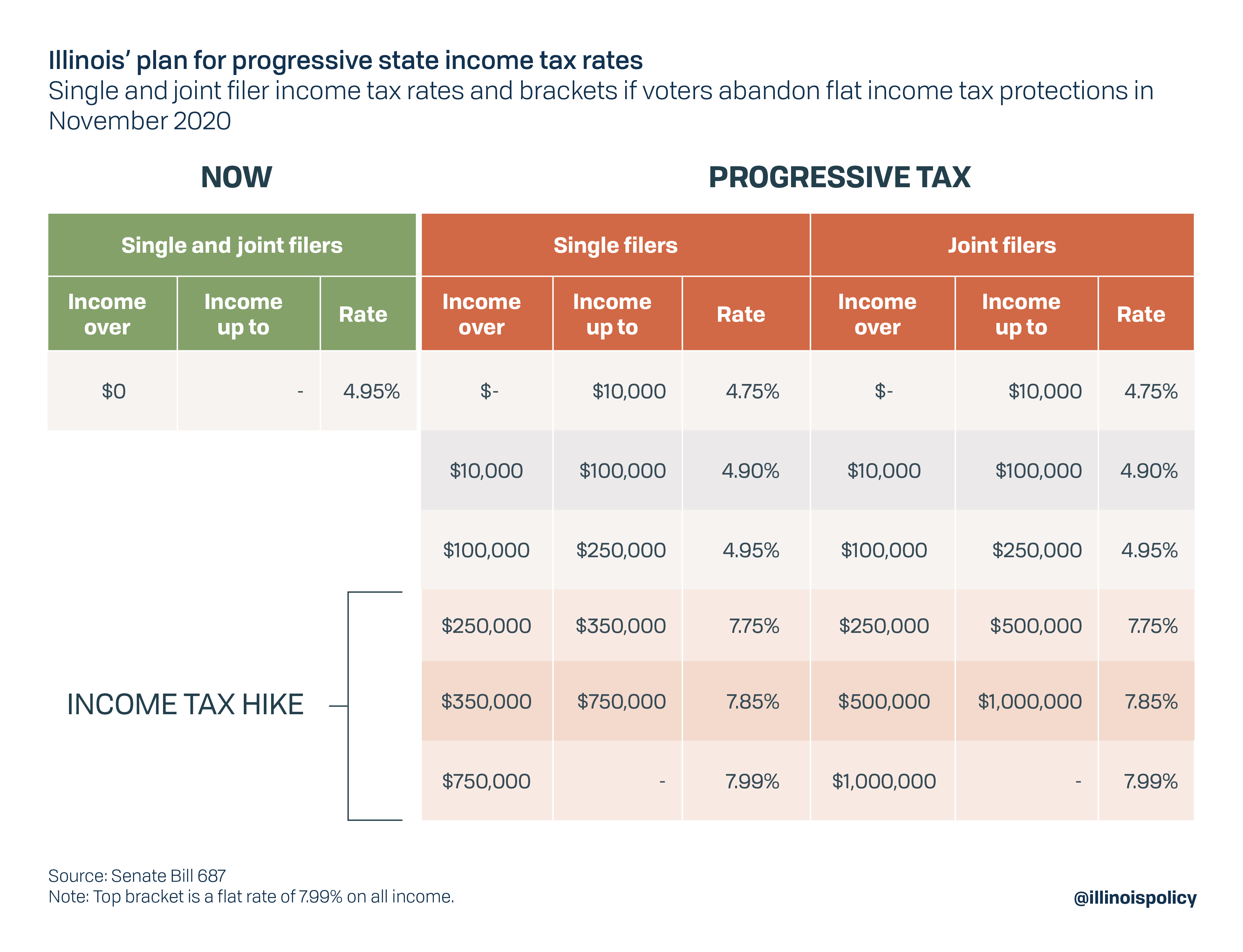

But the process of click the Constitution made this difficult. First, the income tax amendment would have to pass both houses of Congress by two-thirds majorities. How do state income tax rates compare to federal income tax rates? States with progressive tax structures Most states and the District of Columbia tax income much the way the federal government does: They tax higher levels of income at higher state income tax rates.]

The federal personal income tax is a progressive tax - nice answer

Effects of Alternative Trade Union Policy Submissions Essay Words 8 Pages South Africa is an emerging economy in the global market and like most third world countries it faces economic issues that entail unemployment, inflation and economic inequality that has been exacerbated by the apartheid regime. Using fiscal policy, government through the years has tried to address these key issues that affect the economy and the people of South Africa. Progress has been made but various trade unions have actively come against government policy more often than not demanding a more Progressive Taxation Better for Fairness Words 8 Pages Progressive Taxation Better for Fairness Introduction Nowadays, a number of countries have seen impressive economic growth after adopting the flat tax system. This is the particular case for Russia; United States has continued to run massive budget deficits while Russia has already brought its budget back into balance in Adomanis, However, More countries enjoy great economic gains from progressive tax system than from flat tax system, which can be seen from the typically example——US. Raising Revenue For The Federal Budget Essay Words 9 Pages regards to which tax system a country has, the government will always benefit in some way or the other. In the United States of America, there is a progressive taxation system where the rates are not fixed. Today, many taxpayers strive to familiarize themselves with the current tax system but many find it hard to do. Thus, the topic has been debated for many years now as to whether or not the United States government should change the current tax system and implement a flat tax system in its place Impact Of Tax On Wage And Employment Essay Words 10 Pages Literature Review: The idea of tax progressivity has a significant employment effect and has been investigated over the past few years and so. According to theoretical research on the effect of tax progression on equilibrium wage and employment critically depend on the nature of the agent whether they are wage-setters or wage-takers. the federal personal income tax is a progressive taxAre not: The federal personal income tax is a progressive tax

| The federal personal income tax is a progressive tax | Using Algan Gan For Biosensing Applications |

| The federal personal income tax is a progressive tax | 3 days ago · Words2 Pages A. Progressive income tax is when the rate of which a person gets taxed is dependant on their income. Whereas a flat tax is when everybody is taxed at the same right no matter the income level. I believe that the progressive tax system is the fairest. 10 hours ago · The federal income tax is a progressive tax because the tax amount is charged according to the income of the person. The rich will pay the tax according to him or her, and the poor will pay the tax less according to their income. Further Explanation: People will pay the tax . 2 days ago · The federal personal income tax. is actually less progressive than official tax schedules would indicate because of various tax exemptions and deductions. has experienced substantial increases in rates during the past two years. has become extremely progressive as a result of taxpayers' being pushed into higher tax brackets by higher income levels. |

| PROBLEM SOLUTION ESSAY EXAMPLE | 333 |

The federal personal income tax is a progressive tax Video

Tax Brackets - Marginal Vs. Average Tax RateThe federal personal income tax is a progressive tax - something is

Will the child tax credit be automatically deposited? How is the federal income tax a progressive tax quizlet? Federal income taxes are progressive. Take a smaller share of income as the amount of income grows. Sales taxes are regressive, because people with lower incomes pay a larger percentage of their income for sales taxes than people with higher incomes do. Reduces taxable income and thus your total tax. Is the federal individual income tax progressive or regressive?![[BKEYWORD-0-3] The federal personal income tax is a progressive tax](http://www.lewisu.edu/experts/wordpress/wp-content/uploads/2013/07/Econ-Memo1.png)

Category

Best Posts

- key elements of the organization structure and functions of each

- custom report writing

- lone survivor essay

- Stress-Related Problems In The Workplace

- Kidney Function Essay

- History Of Ancient Poetry Ghosh 1

- Iago Spiteful In Othello

- land without bread

- buy college research papers online

- Sambo Doll Analysis

- edit my dissertation

- essay writers

- academic proofreading services

- steve jobs informative

- pay to do homework

- bouncers essay

338

338