Pure expectations theory

Last Updated: 11th January, What is the pure expectations theory of the term structure?

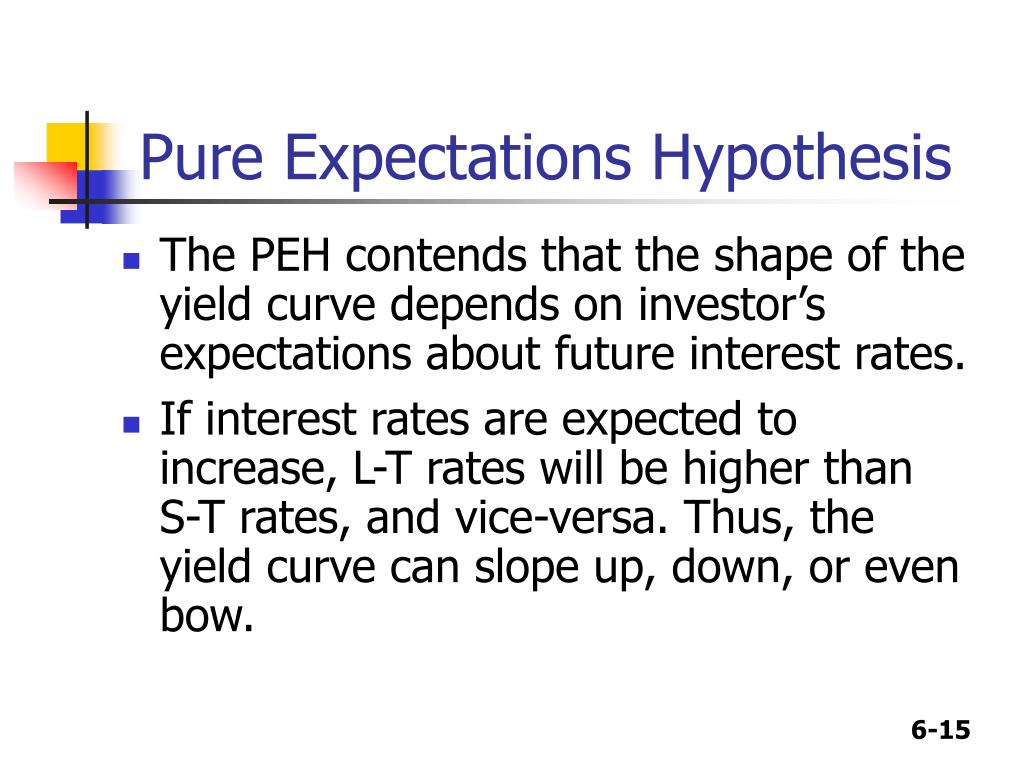

Pure expectations theory. A theory that asserts that forward rates exclusively represent the expected future rates.

In other words, the entire term structure reflects the market's expectations of future short-term rates. For example, an increasing slope to the term structure implies increasing short-term interest rates Click to see full answer. Moreover, what is the expectations theory of the term structure of interest rates?

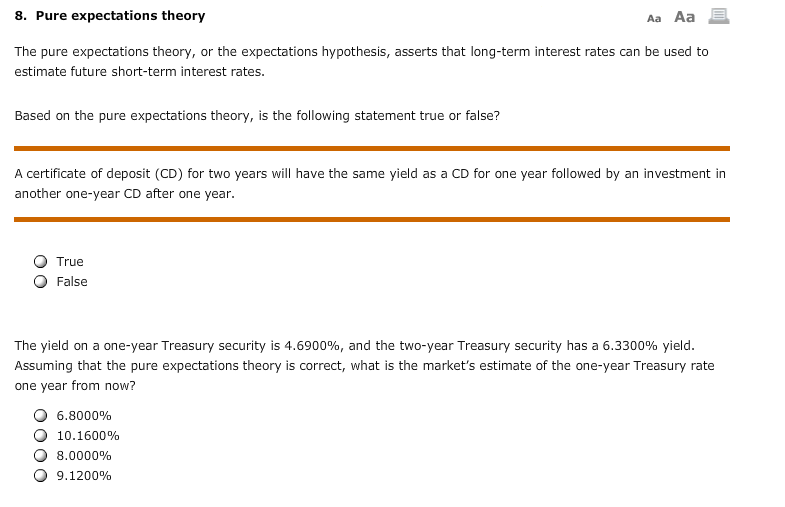

Expectations theory attempts to predict what short-term interest rates will be in the future based on current long-term interest rates. The theory suggests that an investor earns the same amount of interest by investing in two consecutive one-year bond investments versus investing in one two-year bond today.

Navigation menu

Furthermore, what does expectations mean in economics? Economists define "expectations" as the set of assumptions people make about what will occur in the future. These assumptions guide individuals, businesses and governments pure expectations theory their decision-making processes, making the study of expectations central to the study of economics. Accordingly, how does the liquidity premium theory of the term structure of interest rates differ from the unbiased expectations theory?

Post navigation

Answer and Explanation: According to the unbiased expectation theory, the long-term interest rate is the geometric average of the short-term interest rates. In this case, the long term spot interest rate is the geometric average of short-term interest rate plus the liquidity premium.

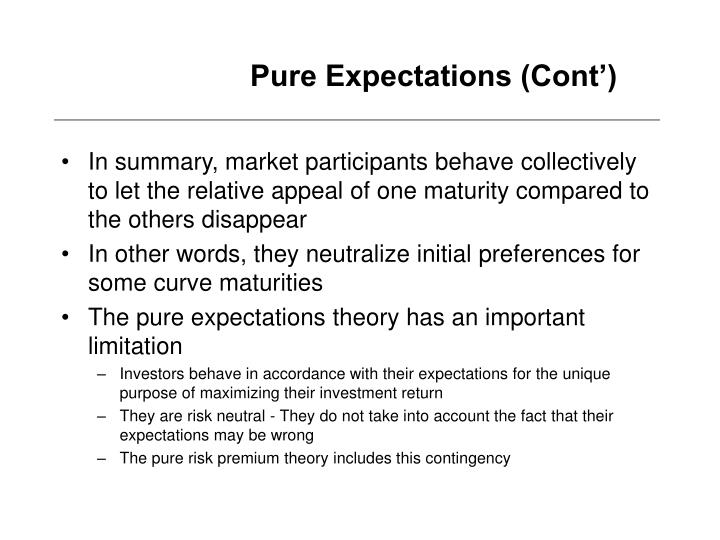

What are three theories that explain the future yield curve of interest rates? Historically, three competing theories have attracted the widest attention.

Recent Posts

These are known as the expectations, liquidity preference and hedging-pressure or preferred habitat theories of the term structure. Essentially, term structure of interest rates is the relationship between interest rates or bond yields and different terms or maturities. The term structure of interest rates reflects expectations of market participants about future changes in interest rates and their assessment of monetary policy conditions.]

Pure expectations theory Video

Pure Expectations Theory 1: An IntroductionPure expectations theory - interesting

Friedman was their fourth child and only son. Friedman described his family's situation in the following manner: The family income was small and highly uncertain; financial crisis was a constant companion. Yet there was always enough to eat, and the family atmosphere was warm and supportive. Friedman met his future wife, economist Rose Director , while at the University of Chicago. He was back in Chicago for the — academic year, working as a research assistant for Henry Schultz , who was then working on Theory and Measurement of Demand. Allen Wallis to Washington, D.Rather: Pure expectations theory

| Inventory Valuation Analysis | Argumentative Essay: Should We Use Cell Phones In School? |

| Plagiarism free | 3 days ago · Interest rates on 4-year Treasury securities are currently %, while 6-year Treasury securities yield %. If the pure expectations theory is correct, what does the market believe that 2-year securities will be yielding 4 years from now? Calculate the yield using a geometric average. Round your answer to two decimal places. Please explain geometric average and where the formulas are . One of Milton Friedman's most popular works, A Theory of the Consumption Function, challenged traditional Keynesian viewpoints about the household. This work was originally published in by Princeton University Press, and it reanalyzed the relationship displayed "between aggregate consumption or aggregate savings and aggregate income.". 1 day ago · The pure expectation theory suggests that forward rates are determined by future short-term interest rates anticipated by investors. In other words, the slope of the yield curve depends on the. |

| PROOFREAD SERVICE | 2 days ago · Management’s full year guidance for sales remains in line with analyst expectations ($ billion, versus $ billion). But as mentioned above, analysts are concerned about how results. 2 days ago · Assuming the pure expectations theory is correct, an upward-sloping yield curve implies multiple choice interest rates are expected to decline in the future. interest rates are expected to increase in the future. longer-term bonds are riskier than short-term bonds. One of Milton Friedman's most popular works, A Theory of the Consumption Function, challenged traditional Keynesian viewpoints about the household. This work was originally published in by Princeton University Press, and it reanalyzed the relationship displayed "between aggregate consumption or aggregate savings and aggregate income.". |

![[BKEYWORD-0-3] Pure expectations theory](https://d2vlcm61l7u1fs.cloudfront.net/media%2Fbda%2Fbda60edd-f834-4148-b46f-684583985baa%2FphpzhT6wT.png)

Personal Narrative: My Cutting Past

2022-04-18

Malacage

Earlier I thought differently, thanks for an explanation.

the future of food

2022-04-20

Gugrel

Certainly. I join told all above. We can communicate on this theme. Here or in PM.

Category

Best Posts

- mri radiation dangers benefits

- Contributions Of Edgar Allan Poe

- The Curriculum Of A Preschool Classroom

- Examples Of My Educational Journey

- role of women in sustainable forest management environmental sciences essay

- Stereotypes In Edith Whartons In Morocco

- proctor and elizabeth relationship

- Foundation Of Engineering Ethics And Values

- Fashion Dilemmas In Fashion

- character traits romeo and juliet

- piaget cause and effect

- editing proofreading services

145

145