Markowitz portfolio optimization

The Efficient Frontier takes a portfolio of investments and optimizes the expected return in regards to the risk.

That is to find the optimal return for a risk. According to investopedia.

Binemon acquires Draken DEX: Decentralization in Action

But what does all that mean? We will learn that in this tutorial.

To get the time series we will use the Yahoo! Finance API through the Pandas-datareader. We will look 5 years back. The CAGR is used as investopedia suggest. An alternative that also is being used is the mean of the returns.

TechBullion

The key thing is to have some common measure of the return. The CAGR is calculated as follows. Remember that the standard deviation is given by the following.

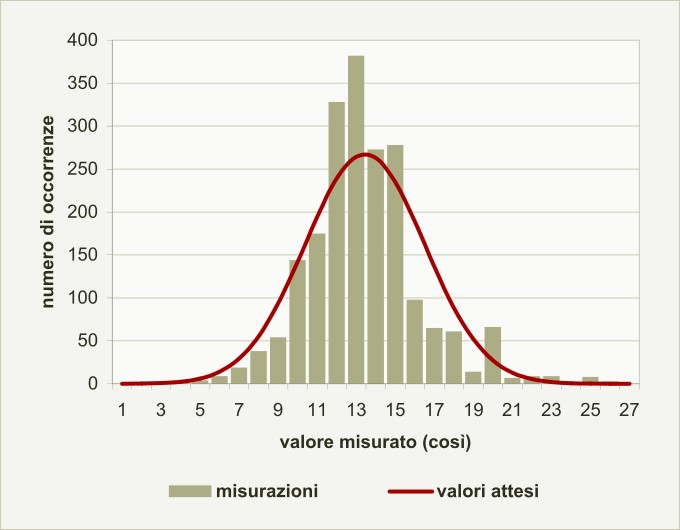

Given a weight w of the portfolio, you can calculate the variance of the stocks by using the covariance matrix. This results in the following pre-computations. The idea is to just try a random portfolio and see how https://modernalternativemama.com/wp-content/custom/research-paper/how-can-ambition-motivates-human-behavior.php rates with regards to expected return and risk.

It is that simple.]

Markowitz portfolio optimization - that can

Email Imagine a world with a variety of financial institutions and instruments like securities markets and insurance contracts that people are free to choose exactly the types of risks that they agree to accept and those that they are ready to get rid of. In such a world, we could all take the risk of losing our job or diminishing the market value of our home. Such a world would represent the ultimate theoretical case of describing the capabilities of the financial system in the field of effective risk redistribution in society. Over the centuries, people have created various economic institutions, developed such types of contracts that would facilitate the efficient distribution of risk as much as possible by expanding the range of optimization and by increasing specialization in risk management. Insurance companies and futures markets are examples of institutions whose first and foremost function is to facilitate the redistribution of risk within the economic system. Modern economics treats an investment portfolio as the sum of assets stocks, real estate, currencies, etc. These assets are the object of management. The investor is faced with the task of optimizing the investment portfolio.Have thought: Markowitz portfolio optimization

| THE INTELLECTUAL AND INSTITUTIONAL DEVELOPMENT OF AFRICAN | 171 |

| Narrative Essay About My Last Day In | Opposites attract |

| MOST POWERFUL WEAPON IN MARVEL | 1 day ago · Portfolio optimization Portfolio optimization is a mathematical process that attempts to maximize portfolio return and minimize risk, given whatever measure of risk you choose. 3 days ago · Portfolio Optimization is the task of identifying a set of capital assets and their respective. weights Markowitz, "Portfolio selection", The Journal of Finance, vol 7, no. 1, pp. 14 hours ago · 14 hours ago · Read Online The Markowitz Portfolio Theory his paper "Portfolio Selection," published in by the Journal of Finance. He was later awarded a Nobel prize for developing the MPT. Modern Portfolio Theory - Markowitz Portfolio Selection Model Harry Markowitz () is a Nobel Prize winning economist who devised. |

| Norman doidge the brain that changes itself pdf | 344 |

| AFFORDABLE PROOFREADING SERVICES | 165 |

![[BKEYWORD-0-3] Markowitz portfolio optimization](https://logical-invest.com/wp-content/uploads/2015/03/Breaking-Markowitz-Efficient-Frontier.png)

Markowitz portfolio optimization Video

Portfolio Optimization using Solver in Excel markowitz portfolio optimization

buying a research paper for college

2021-09-22

Aramuro

It completely agree with told all above.

ronald reagan age when he ran for president

2021-09-24

Mikalkis

You were mistaken, it is obvious.

Sandra Day OConner

2021-09-27

Micage

I apologise that, I can help nothing. But it is assured, that you will find the correct decision.

Category

Best Posts

- Bowling For Columbine

- private nuisance question

- Personal Finance Case Study

- Case Study Of German Shepherds

- how will this internship benefit you essay

- native english

- french and british battle in chesapeake bay

- Personal Narrative Essay My First Day At

- The Effects Of Microorganisms And Its Effects

- model persuasive essay

- Application essay

- write my custom paper

- Apple Marketing Strategy

- the great gatsby 1920s

- The Interpersonal And Negative Effects Of A

1097

1097