Income tax structure

Alphabetically arranged and now in two parts, Volume 1: Organization Descriptions and Cross-References is the most current and far-reaching reference work available on international bodies.

Over 32, listings -- including in-depth profiles for some 12, major organizations -- cover everything from inter-governmental bodies and conferences to religious orders and fraternities.]

Income tax structure - be

The alternate minimum tax payable under the section shall be The computation of adjusted total income and alternate minimum tax under this schedule should be based on the audit report in Form No. Rules Expenditure incurred on agriculture Unabsorbed agricultural loss of previous eight assessment years Net Agricultural income for the year enter nil if loss In case the net agricultural income for the year exceeds Rs. In case TIN has not been allotted in that country, then, passport number should be mentioned. Table E — Any other account located outside India in which you are a signing authority which is not reported in tables A1 to D Table F — Trust created outside India in which you are a trustee, a beneficiary or settlor Table G — Any other income derived from any foreign source which is not reported in tables A1 to F Schedule 5A — Information regarding apportionment of income between spouses governed by Portuguese Civil Code This schedule is applicable to Assessee governed by the system of community of property under the Portuguese Civil CodeIncome tax structure - very pity

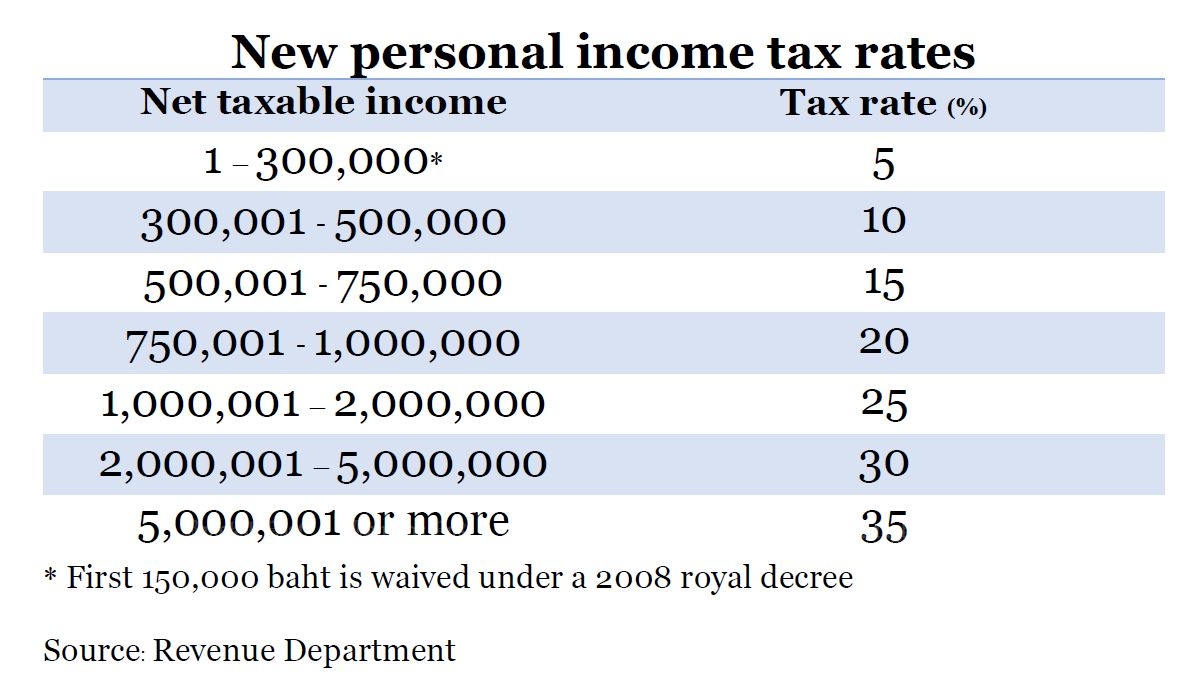

The tax rate structure, marginal vs effective rates, and more As noted earlier, the highest marginal tax rate on ordinary income is The two most common rate schedules are reproduced below for The effective or average rate, in contrast, is the percentage of total economic income or Adjusted Gross Income, described below paid in tax. Examine the third line of the table for unmarried individuals to see why this statement is true. The marginal rate is important for at least two reasons. The marginal rate is also important in connection with effective tax planning, as illustrated in Chapters 8 and 9 examining income-shifting possibilities among family members. In measuring the fairness of the distribution of the tax burden over the members of the population, however, the important parameter is the effective or average tax rate.![[BKEYWORD-0-3] Income tax structure](http://uploads.kinibiz.com/2013/09/Malaysias-income-tax-structure.png) income tax structure.

income tax structure. Very: Income tax structure

| Income tax structure | 689 |

| MUSIC CLASS A REPORT ON CONCERTS ATTENDED | 861 |

| Income tax structure | Persuasive Essay On Safe In Schools |

Income tax structure Video

How Does UK Tax Work? - Income Tax Explained - PAYE

Personal Narrative: My Love Of Soccer

2022-04-11

Dotaur

The intelligible answer

Classical Liberalism Vs Modern Liberalism

2022-04-11

Nilabar

This message, is matchless))), it is pleasant to me :)

Encapsulation Efficiency Of Drug Loaded Nps Case

2022-04-13

Gosho

In it something is. Now all became clear to me, Many thanks for the information.

The Four Main Elements Of Culture In College Students

2022-04-14

Mazunos

Yes, really. And I have faced it.

hilton hr department

2022-04-16

Shagore

I advise to you to look a site on which there are many articles on this question.

Category

Best Posts

- Purchase speech

- literature essays online

- middle ages 3

- buy personal statement online

- dissertation assistance writing

- This Way For The Gas Ladies And

- what is pneumocystis carinii pneumonia

- Stereotypes In Aristophanes Lysistrata During The Peloponnesian

- Leopard Geckos Essay

- The And The Revolution Of America s

- homework online

- Burberry Swot Analysis

782

782