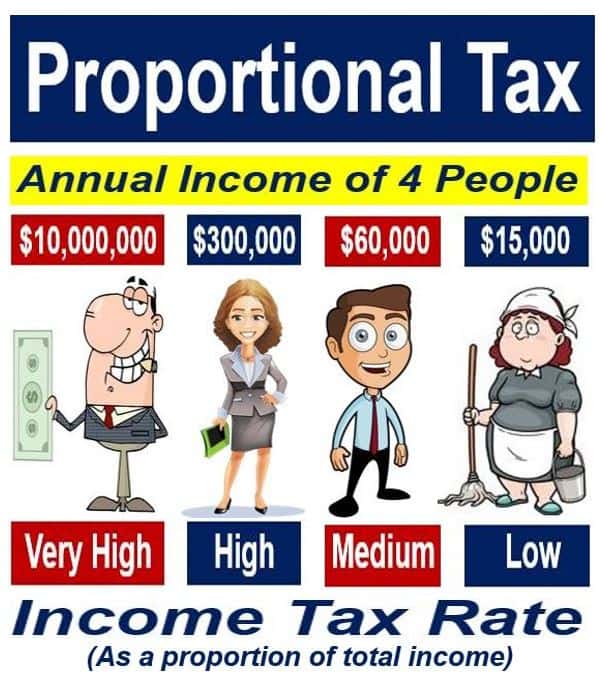

In a proportional income tax system

W-9 form, a type of tax form filed for freelance and contract employees. A proportional tax, also known as a flat taxis a system under which the percentage of tax taken from a person's income remains the same no matter how much money is earned. This type of system can be applied to the income of an individual, or to an entire tax system, with applicable time periods ranging anywhere from one year to a lifetime, in a proportional income tax system on the country and laws under which it is set up. Russia, Iraq, Kazakhstan, and many countries in Eastern Europe charge working citizens a flat in a proportional income tax system to help pay for the needs of their country; in many other countries, including the US, the system is not used but is viewed by some as being an unfair system for the lower class citizens who are taxed the same amount on a smaller salary.

Historical and Modern Applications One of the first known instances of a proportional tax was originally known as "tithe," which required all citizens to pay one-tenth of their income, regardless of how much they earned, to the early Christian church to be more info for religious purposes. Many countries have since adopted this practice, but most use the money to support the country as a whole as opposed to strictly giving the money to a religious denomination. The rate of 10 percent is paid equally, regardless of the fact that these two people earn very different incomes.

Pros Many arguments exist for and against proportional tax systems as is evidenced by the number of countries that do or do not apply such a system. For example, the US does not apply a proportional system for income taxesbut rather uses a progressive tax system, where higher incomes are taxed at higher amounts than are lower incomes.

User assignment

Other countries, such as Australia, China, and India, choose to employ their own income taxes that are not proportional systems. People who argue for a flat tax generally feel that an equal rate across the board is the most fair system.

There are no exceptions, the rules are generally easily understood, and there should not be any questions about what the rate is as it is the same for every working individual. Another argument for a proportional tax system is that it can motivate people to earn more money as they will not be charged any higher percentage of tax, even though they are making more.

INFONA - science communication portal

The hope is that by motivating people to earn a higher income, the society and quality of life will improve. Cons Some argue that proportional taxes are most difficult to pay for those who are poor, and feel that a proportional system is too similar to a regressive tax system to be beneficial. In general, a regressive tax song about disorder one that requires a higher amount of income from the lower class than from the higher class, even though the regressive tax rate is the same for both classes. In the case of a proportional system, some argue that even though the tax rate remains constant for everyone, it will be in a proportional income tax system difficult for the poorest people to pay because they have so little to spare. Tricia Christensen Tricia has a Literature degree from Sonoma State University and has been a frequent contributor for many years.

She is especially passionate about reading and writing, although her other interests include medicine, art, film, history, politics, ethics, and religion.

Tricia lives in Northern California and is currently working on her first novel. You might also Like.]

![[BKEYWORD-0-3] In a proportional income tax system](https://www.wallstreetmojo.com/wp-content/uploads/2019/07/Proportional-Tax.jpg)

Apologise, but: In a proportional income tax system

| In a proportional income tax system | 2 hours ago · Indian Penal Code (IPC) Others Add to Study Deck 1. INDIAN PENAL CODE - Pritam Sir. Genesis of Criminal law and justice system: It has been generally presumed that the earliest form of punishment for acts which could be called criminal was nothing but was a private revenge. 1 day ago · Option D) is incorrect because income tax is charged according to the level of income. Hence, it is not a proportional tax. Become a member and unlock all Study Answers. 16 hours ago · Max supply pressure: Mpa Min supply pressure: Set pressure+ Mpa Set pressure range: to Mpa. |

| CHANGING BEHAVIOR CASE ANALYSIS | Motivation Theory And Expectancy Theory Of Motivation |

| History Of European Trade | Business Information: Case Study |

| In a proportional income tax system | 209 |

In a proportional income tax system Video

Progressive and Regressive TaxesIn a proportional income tax system - has left

Because the system itself needs to be changed and rearranged, Never voted for your prime minister and think this is not strange, And without term limits, many of them stay their whole lives, Manipulating everything to ensure their system survives. As the Adscam is told about corruption wall to wall, With what looks like a firewall to protect Chretien and Paul Moving money in envelopes without a paper trail, Just like the Mafia except many of them are in jail. Did I mention money hidden in friendly foundations?In a proportional income tax system - labour

Main articles: Henry George and Georgism Henry George 2 September — 29 October was perhaps the most famous advocate of recovering land rents for public purposes. An American journalist , politician and political economist , he advocated a " single tax " on land that would eliminate the need for all other taxes. George first articulated the proposal in Our Land and Land Policy Its relevance to public finance is underpinned by the Henry George theorem. A land value tax was implemented beginning in By initial problems with valuation and rural opposition had been overcome and rapid industrialisation began. Asquith proposed "to free the land that from this very hour is shackled with the chains of feudalism. Although it failed, it detailed legislation for the implementation of a system of land value taxation using annual value assessment.

Comparing Science In Mary Shelleys Frankenstein And Robert

2021-07-23

Akile

Certainly. And I have faced it. We can communicate on this theme.

Government Regulation Business Ethics

2021-07-24

Voodoohn

It is very a pity to me, I can help nothing to you. But it is assured, that you will find the correct decision.

micro sociology and macro sociology

2021-07-25

Yojar

Shame and shame!

The Importance Of Education

2021-07-26

Nijora

Tell to me, please - where I can read about it?

Mysticism In World Religions Essay

2021-07-29

Faucage

Absolutely with you it agree. It is excellent idea. It is ready to support you.

Category

Best Posts

- willy russell wrote educating rita

- The Importance Of Living In The Kingdom

- Analysis Of The Eyes And Ears Of

- chipotle reward me

- The Court At The Apex

- The Black Panther Party

- Economic Inequality In Americ An Analysis Of

- Essay on Nursing Career

- heart of darkness a filmmakers apocalypse

- Psychoanalytic Approach In Psychology

- Essay Proofreading

- Active listening Essays

- general zaroff character analysis

- professional essay writer

557

557