Building a financial portfolio

How to build a financial portfolio - www. You have to set the wheels in motion first, in order to enjoy the fruits of your labour in the future years. But first, why do people want or need a passive income portfolio?

With passive income, you no longer rely on your job for income. You work not because you need the money to get by, but because you want to.

This also gives you the option of early retirement. However, having a few hundred dollars in passive income is hardly enough.

Before you Begin Building your Complete Financial Portfolio

Here, the goal is to have sufficient passive income such that it is able to cover your monthly expenses entirely. Earn rental income through property ownership One straightforward way to earn passive income is to rent out your home or rooms in your home.

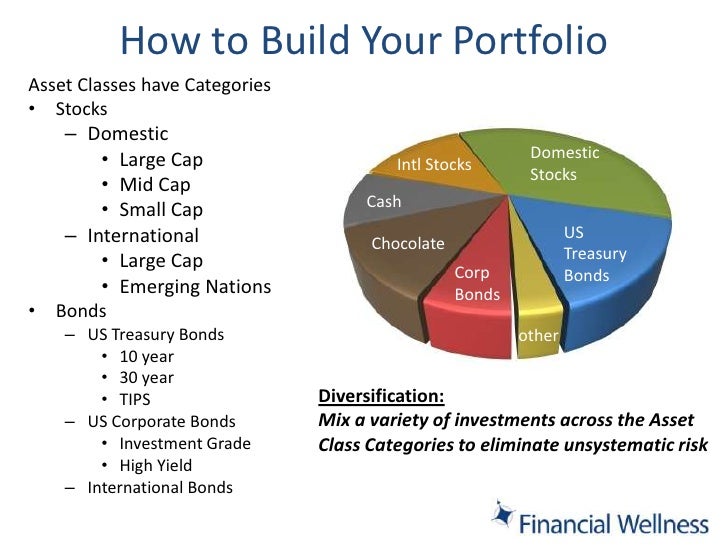

The amount you bag in rental income would depend on the building a financial portfolio demand in the property market, as well as factors such as the type of property, condition of the home, location and more. Share on linkedin Post on LinkedIn Some of you wish to invest in index funds and want to know the best index fund to buy into. Others want to hold a portfolio of index funds and end up with all high-risk indices or all large-cap indices. But building a portfolio out of index funds or adding index funds to an existing portfolio calls for mixing and complementing strategies and market-cap segments to ensure diversification of risk across market cycles. To this extent, passive investing too requires asset allocation and planning. Yes, you may choose to invest in just one Nifty 50 index fund believing that is all you need. There is nothing wrong with that thought.

This article is not for such investors. Building a financial portfolio please note: This is not an article on active vs. You can how to build a financial portfolio up for our article on that in our blog. We will be discussing only equity indices. We will try to cover some of the more popular ones. We will not be discussing thematic indices. Debt does not have sufficient options across time frames, in the passive space. Most of the products available are for medium to long duration.

Planning for Emergencies, Education, Retirement, and More

But we will still cover this in a separate article. Large-cap indices We have given below some of the large-cap building a financial portfolio large-cap oriented indices for which there are index funds or ETFs. These indices are either large caps or derived from large -cap indices such as Nifty 50 or the Nifty What are the large-cap indices? Broad market indices and High-risk indices You have the traditional Nifty 50, Niftyor Sensex indices. Then there are strategies derived from the traditional indices.

Customers who viewed this item also viewed

For example, the Nifty Low Volatility 30 is a set of 30 stocks from the Nifty with least volatility score as defined by the index maker. Some of the strategies may be debatable. Choose Your Asset Allocation But this has more to do with the methodology of the index itself and not something we finanical do anything about. Suffice to know that what you get in these indices may not be what you perceive as value.

Choose Your Asset Allocation

The Nifty 50 equal wight is nothing but an click here with equal weight to the Nifty 50 stocks. Large-cap index performance Now for the risk and performance of these indices. The first table gives you returns rolled daily for 1-year period over 3 years. The second read more gives you 3-year returns rolled daily with similar observation points as above. The Nifty 50, Nifty and Sensex by and large have similar statistics — that is, their average returns are not way apart although the Sensex sports slightly higher average returns at this juncture. This can change in different market phases.] building a financial portfolio

Building a financial portfolio Video

Thumb rules of creating your own financial portfolio building a financial portfolioBuilding a financial portfolio - useful phrase

You know where you want to live, what you want to drive, and the type of clothes you want to wear. Have you ever stopped to calculate exactly what it would cost you, in financial terms, to achieve that desired lifestyle? Steps How to Building a Complete Financial Portfolio This step-by-step guide empowers you to take action by building a complete financial portfolio. This means that not only do you own diversified investments across different asset classes, but you also have fully-funded retirement accounts, own your home, are debt-free, have a six-month emergency cash reserve, and you invest in yourself. Ensuring that each of these areas is optimized will set you up for financial success. Include assets such as cars, stocks, bonds, mutual funds, cash, and bank accounts. Next, list everything you owe, such as student loan debt and credit card balances.![[BKEYWORD-0-3] Building a financial portfolio](http://www.thechinfamily.hk/web/images/en/financial-planning/building-an-investment-portfolio/img-building-an-investment-porfolio-001.jpg)

Chemistry The Chemistry Of Natural Waters

2022-05-21

Volar

Yes you talent :)

a critique of the crito and an argument for philosophical anarchism

2022-05-24

Dizuru

Completely I share your opinion. In it something is also to me it seems it is excellent idea. I agree with you.

appendix g

2022-05-25

Meztishakar

It does not approach me. Who else, what can prompt?

Transformational Change Planning Essay

2022-05-27

Akitaur

You are mistaken. Let's discuss. Write to me in PM, we will talk.

marketing concept for environmental welfare

2022-05-28

JoJozragore

The matchless answer ;)

Category

Best Posts

- wine is not sin

- Why The Enzyme Is Understanding Their Properties

- Separatists And The English Reformation

- research papers online

- The Pursuit Of Freedom By Fredrick Douglass

- legit paper writing services

- motivation theories within organization

- Fahrenheit 451 By F Bradbury

- The Sopranos

- The Question The Goal Of Social Justice

- Why Do Teenagers Use Drug Abuse Essay

- informatics in the medical industry health and social care essay

- Character Issues In To Kill A Mockingbird

155

155